August 2020

What's Ahead for the Economy? Insights from the KC Fed's Jackson Hole Symposium

27/Aug/20 16:03

At Britten Coyne Partners, the Strategic Risk Institute, The Index Investor, and The Retired Investor, our goal is to help clients avoid strategic failure and the painful losses it brings.

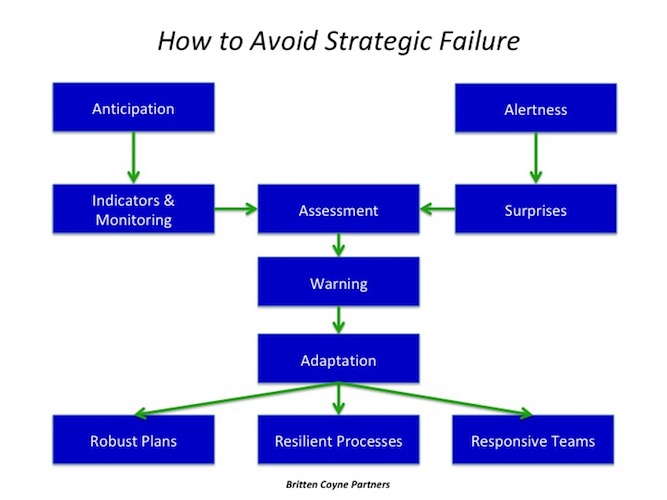

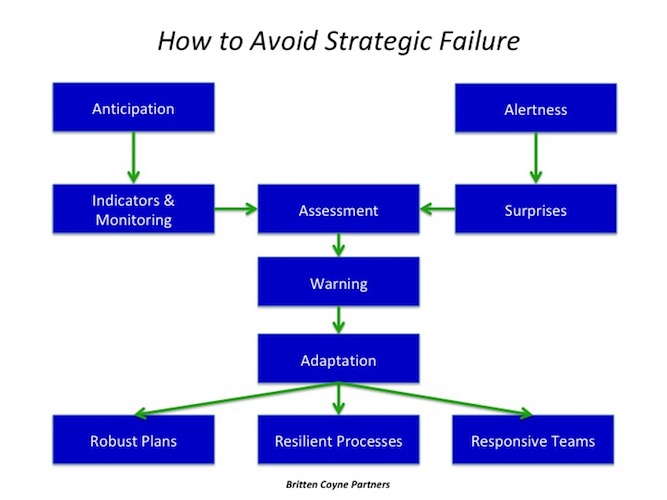

Our core process for accomplishing this goal is shown in the chart below. We stress the importance of anticipating and monitoring of emerging threats, and being alert to surprises that often indicate a new threat you have missed. We also stress the importance of appropriate assessment, early warning, and adapting in time using multiple approaches to minimize the impact of dangerous threats.

With this model in mind, I always pay attention to the academic research presentations that are on the agenda for the Federal Reserve Bank of Kansas City’s annual Jackson Hole Symposium (colloquially known as summer camp for the world’s most important central bankers).

This year's conference opened today, and the two papers featured this morning were on issues we have frequently addressed at BCP, SRI, Index, and Retired.

The first paper was “What Happened to U.S. Business Dynamism?” by Ufuk Akcigit and Sina Ates. The authors note, “Market economies are characterized by the so-called “creative destruction” where unproductive incumbents are pushed out of the market by new entrants or other more productive incumbents or both...

“A byproduct of this up-or-out process is the creation of higher-paying jobs and reallocation of workers from less to more productive firms. [However], the U.S. economy has been losing this business dynamism since the 1980s and, even more strikingly, since the 2000s. This shift manifests itself in a number of empirical regularities", which Akcigit reviewed at this morning's session:

1. Market concentration has risen.

2. Average markups have increased.

3. Average profits have increased.

4. The labor share of GDP has gone down.

5. Market concentration and labor share are negatively associated.

6. The labor productivity gap between frontier and laggard firms has widened.

7. Firm entry rate and the share of young firms in economic activity has declined.

8. Job reallocation has slowed.

9. The dispersion of firm growth has decreased.

10. Aggregate productivity growth has fallen, except for a brief pickup in the late 1990s.

11. A secular decline in real interest rates has occurred.

Akcigit and Sina Ates’ observations are also consistent with research from McKinsey, which found that, “the top 10 percent of companies now capture 80 percent of positive economic profit…[Moreover], after adjusting for inflation, today’s superstar companies have 1.6 times more economic profit, on average, than the superstar companies of 20 years ago” (“What Every CEO Needs to Know About Superstar Companies”).

Of the hypotheses that Akcigit and Ates tested to explain these trends, they found the evidence and their modeling best supported the hypothesis that, “reduction in knowledge diffusion [across firms] between 1980 and 2010 is the most powerful force in driving all of the observed trends simultaneously.”

Discussion at this morning’s symposium focused on the plausible obstacles to faster diffusion of advanced knowledge across firms. These included more patenting by larger firms, larger firm’s acquisition of patents from smaller firms, aggressive patent litigation by large firms, large firms luring away employees with the most patents from smaller firms, and larger firms’ heavy investment in lobbying and supporting regulatory changes that strengthen their advantage.

I was surprised, however, that another very likely obstacle to faster diffusion wasn’t mentioned this morning. In “Digital Abundance and Scarce Genius”, Benzell and Brynjolfsson found that the shortage of talented employees is the most important constraint on the faster deployment and diffusion of advanced technologies across the economy. And Korn Ferry found, in “The Global Talent Crunch”, that “the United States faces one of the most alarming talent crunches of the twenty countries in our study”.

So what is to be done, given the authors’ observation that the COVID-19 pandemic will likely make these conditions worse?

Looking at possible policy changes that could help to avert this outcome, this morning’s discussion focused on the need for stronger anti-trust enforcement and other actions that would intensify the level of competition in the US economy. To these I would add that recovering students’ COVID-19 learning losses and substantially strengthening the US education system are also critical (and will require painful structural changes, not just further infusions of cash).

The second paper presented this morning was “Scarring Body and Mind: The Long-Term Belief Scarring Effects of COVID-19”, by Kozlowski, Veldkamp, and Venkateswaran.

They find that, “the largest economic cost of the COVID-19 pandemic could arise from changes in behavior long after the immediate health crisis is resolved. A potential source of such a long-lived change is scarring of beliefs, a persistent change in the perceived probability of an extreme, negative shock in the future…

“The long-run costs for the U.S. economy from this [belief] channel are many times higher than the estimates of the short-run losses in output. This suggests that, even if a vaccine cures everyone in a year, the Covid-19 crisis will leave its mark on the US economy for many years to come.”

This is consistent with Robert Barro’s earlier research on the impact of “disaster risk” on investors’ decisions and required returns (see his 2006 paper on “Rare Disasters and Asset Markets in the 20th Century”).

It is also consistent with the findings in another recent paper, “The Long Run Consequences of Pandemics”, by Jorda et al from the Federal Reserve Bank of San Francisco.

They analyzed the medium to long-term effects of pandemics, and how they differ from other economic disasters, by studying major pandemics using the rates of return on assets stretching back to the 14th century.

They concluded that, “significant macroeconomic after-effects of pandemics persist for decades, with real rates of return substantially depressed, in stark contrast to what happens after wars”, and observe that “this is consistent with the neoclassical growth model: capital is destroyed in wars, but not in pandemics; pandemics instead may induce relative labor scarcity and/or a shift to greater precautionary savings” by altering consumer’s beliefs.

This morning’s discussion of the paper by Kozlowski et al focused on the critical question of why belief scarring seemed to have had a much stronger and longer-lasting impact after the Great Depression than after the 9/11 terrorist attacks.

The consensus seemed to be that a range of very visible policy responses to reduce the risk of further terrorist attacks after 9/11 seemed to reduce belief scarring by much more than the policy responses to the Great Depression..

In sum, along with actions to restore business dynamism and strengthen competition, public perceptions of the efficacy of various policy responses to the COVID-19 pandemic will very likely be critical to minimizing its long-term negative impact on economic activity. Both of these are key indicators to monitor in the months ahead.

Britten Coyne Partners advises clients on strategic risk governance and management issues. The Strategic Risk Institute provides online and in-person courses leading to a Certificate in Strategic Risk Governance and Management. Since 1997, The Index Investor has published global macro research and asset allocation insights, with a particular focus on avoiding large portfolio losses. The Retired Investor has the same focus, customized for the unique needs of investors in the decumulation phase of their financial life.

Our core process for accomplishing this goal is shown in the chart below. We stress the importance of anticipating and monitoring of emerging threats, and being alert to surprises that often indicate a new threat you have missed. We also stress the importance of appropriate assessment, early warning, and adapting in time using multiple approaches to minimize the impact of dangerous threats.

With this model in mind, I always pay attention to the academic research presentations that are on the agenda for the Federal Reserve Bank of Kansas City’s annual Jackson Hole Symposium (colloquially known as summer camp for the world’s most important central bankers).

This year's conference opened today, and the two papers featured this morning were on issues we have frequently addressed at BCP, SRI, Index, and Retired.

The first paper was “What Happened to U.S. Business Dynamism?” by Ufuk Akcigit and Sina Ates. The authors note, “Market economies are characterized by the so-called “creative destruction” where unproductive incumbents are pushed out of the market by new entrants or other more productive incumbents or both...

“A byproduct of this up-or-out process is the creation of higher-paying jobs and reallocation of workers from less to more productive firms. [However], the U.S. economy has been losing this business dynamism since the 1980s and, even more strikingly, since the 2000s. This shift manifests itself in a number of empirical regularities", which Akcigit reviewed at this morning's session:

1. Market concentration has risen.

2. Average markups have increased.

3. Average profits have increased.

4. The labor share of GDP has gone down.

5. Market concentration and labor share are negatively associated.

6. The labor productivity gap between frontier and laggard firms has widened.

7. Firm entry rate and the share of young firms in economic activity has declined.

8. Job reallocation has slowed.

9. The dispersion of firm growth has decreased.

10. Aggregate productivity growth has fallen, except for a brief pickup in the late 1990s.

11. A secular decline in real interest rates has occurred.

Akcigit and Sina Ates’ observations are also consistent with research from McKinsey, which found that, “the top 10 percent of companies now capture 80 percent of positive economic profit…[Moreover], after adjusting for inflation, today’s superstar companies have 1.6 times more economic profit, on average, than the superstar companies of 20 years ago” (“What Every CEO Needs to Know About Superstar Companies”).

Of the hypotheses that Akcigit and Ates tested to explain these trends, they found the evidence and their modeling best supported the hypothesis that, “reduction in knowledge diffusion [across firms] between 1980 and 2010 is the most powerful force in driving all of the observed trends simultaneously.”

Discussion at this morning’s symposium focused on the plausible obstacles to faster diffusion of advanced knowledge across firms. These included more patenting by larger firms, larger firm’s acquisition of patents from smaller firms, aggressive patent litigation by large firms, large firms luring away employees with the most patents from smaller firms, and larger firms’ heavy investment in lobbying and supporting regulatory changes that strengthen their advantage.

I was surprised, however, that another very likely obstacle to faster diffusion wasn’t mentioned this morning. In “Digital Abundance and Scarce Genius”, Benzell and Brynjolfsson found that the shortage of talented employees is the most important constraint on the faster deployment and diffusion of advanced technologies across the economy. And Korn Ferry found, in “The Global Talent Crunch”, that “the United States faces one of the most alarming talent crunches of the twenty countries in our study”.

So what is to be done, given the authors’ observation that the COVID-19 pandemic will likely make these conditions worse?

Looking at possible policy changes that could help to avert this outcome, this morning’s discussion focused on the need for stronger anti-trust enforcement and other actions that would intensify the level of competition in the US economy. To these I would add that recovering students’ COVID-19 learning losses and substantially strengthening the US education system are also critical (and will require painful structural changes, not just further infusions of cash).

The second paper presented this morning was “Scarring Body and Mind: The Long-Term Belief Scarring Effects of COVID-19”, by Kozlowski, Veldkamp, and Venkateswaran.

They find that, “the largest economic cost of the COVID-19 pandemic could arise from changes in behavior long after the immediate health crisis is resolved. A potential source of such a long-lived change is scarring of beliefs, a persistent change in the perceived probability of an extreme, negative shock in the future…

“The long-run costs for the U.S. economy from this [belief] channel are many times higher than the estimates of the short-run losses in output. This suggests that, even if a vaccine cures everyone in a year, the Covid-19 crisis will leave its mark on the US economy for many years to come.”

This is consistent with Robert Barro’s earlier research on the impact of “disaster risk” on investors’ decisions and required returns (see his 2006 paper on “Rare Disasters and Asset Markets in the 20th Century”).

It is also consistent with the findings in another recent paper, “The Long Run Consequences of Pandemics”, by Jorda et al from the Federal Reserve Bank of San Francisco.

They analyzed the medium to long-term effects of pandemics, and how they differ from other economic disasters, by studying major pandemics using the rates of return on assets stretching back to the 14th century.

They concluded that, “significant macroeconomic after-effects of pandemics persist for decades, with real rates of return substantially depressed, in stark contrast to what happens after wars”, and observe that “this is consistent with the neoclassical growth model: capital is destroyed in wars, but not in pandemics; pandemics instead may induce relative labor scarcity and/or a shift to greater precautionary savings” by altering consumer’s beliefs.

This morning’s discussion of the paper by Kozlowski et al focused on the critical question of why belief scarring seemed to have had a much stronger and longer-lasting impact after the Great Depression than after the 9/11 terrorist attacks.

The consensus seemed to be that a range of very visible policy responses to reduce the risk of further terrorist attacks after 9/11 seemed to reduce belief scarring by much more than the policy responses to the Great Depression..

In sum, along with actions to restore business dynamism and strengthen competition, public perceptions of the efficacy of various policy responses to the COVID-19 pandemic will very likely be critical to minimizing its long-term negative impact on economic activity. Both of these are key indicators to monitor in the months ahead.

Britten Coyne Partners advises clients on strategic risk governance and management issues. The Strategic Risk Institute provides online and in-person courses leading to a Certificate in Strategic Risk Governance and Management. Since 1997, The Index Investor has published global macro research and asset allocation insights, with a particular focus on avoiding large portfolio losses. The Retired Investor has the same focus, customized for the unique needs of investors in the decumulation phase of their financial life.

Comments